Wrapping up Q4 earnings, we look at the numbers and key takeaways for the aerospace stocks, including Textron (NYSE:TXT) and its peers.

Aerospace companies often possess technical expertise and have made significant capital investments to produce complex products. It is an industry where innovation is important, and lately, emissions and automation are in focus, so companies that boast advances in these areas can take market share. On the other hand, demand for aerospace products can ebb and flow with economic cycles and geopolitical tensions, which can be particularly painful for companies with high fixed costs.

The 14 aerospace stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 1.5% on average since the latest earnings results.

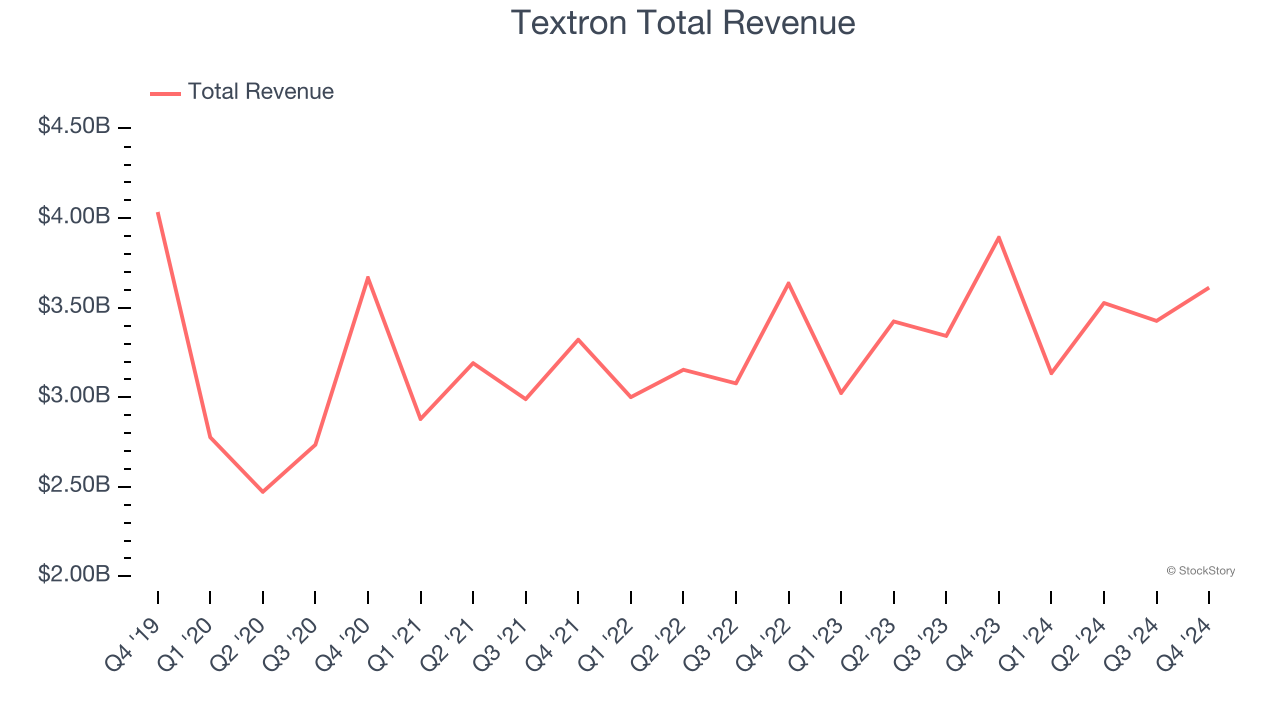

Textron (NYSE:TXT)

Listed on the NYSE in 1947, Textron (NYSE:TXT) provides products and services in the aerospace, defense, industrial, and finance sectors.

Textron reported revenues of $3.61 billion, down 7.2% year on year. This print fell short of analysts’ expectations by 5.9%. Overall, it was a slower quarter for the company with full-year EPS guidance missing analysts’ expectations and a significant miss of analysts’ organic revenue estimates.

The stock is down 7.2% since reporting and currently trades at $75.33.

Read our full report on Textron here, it’s free.

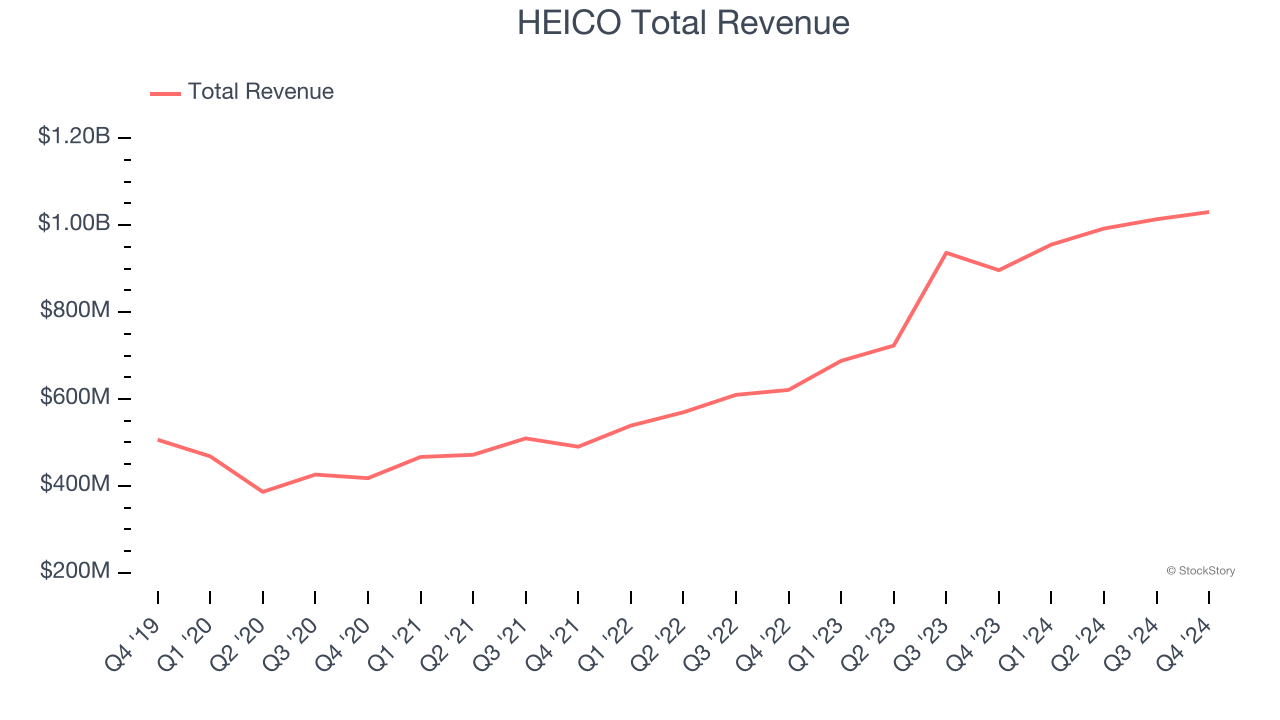

Best Q4: HEICO (NYSE:HEI)

Founded in 1957, HEICO (NYSE:HEI) manufactures and services aerospace and electronic components for commercial aviation, defense, space, and other industries.

HEICO reported revenues of $1.03 billion, up 14.9% year on year, outperforming analysts’ expectations by 5.4%. The business had an incredible quarter with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 13.8% since reporting. It currently trades at $259.26.

Is now the time to buy HEICO? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Boeing (NYSE:BA)

One of the companies that forms a duopoly in the commercial aircraft market, Boeing (NYSE:BA) develops, manufactures, and services commercial airplanes, defense products, and space systems.

Boeing reported revenues of $15.24 billion, down 30.8% year on year, falling short of analysts’ expectations by 6.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

Boeing delivered the slowest revenue growth in the group. As expected, the stock is down 7.5% since the results and currently trades at $162.05.

Read our full analysis of Boeing’s results here.

Redwire (NYSE:RDW)

Based in Jacksonville, Florida, Redwire (NYSE:RDW) is a provider of systems and components used in space infrastructure.

Redwire reported revenues of $69.56 million, up 9.6% year on year. This number missed analysts’ expectations by 6.7%. More broadly, it was a mixed quarter as it also produced full-year EBITDA guidance exceeding analysts’ expectations.

Redwire delivered the highest full-year guidance raise but had the weakest performance against analyst estimates among its peers. The stock is down 2.5% since reporting and currently trades at $10.98.

Read our full, actionable report on Redwire here, it’s free.

Curtiss-Wright (NYSE:CW)

Formed from a merger of 12 companies, Curtiss-Wright (NYSE:CW) provides a range of products and services to the aerospace, industrial, electronic, and maritime industries.

Curtiss-Wright reported revenues of $824.3 million, up 4.9% year on year. This result beat analysts’ expectations by 5.9%. Overall, it was a very strong quarter as it also put up full-year EPS and revenue guidance topping analysts’ expectations.

The stock is down 3.7% since reporting and currently trades at $328.88.

Read our full, actionable report on Curtiss-Wright here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.