News

Three tailwinds could lift this sector when the new Fed Chair makes his mark.

Via The Motley Fool · February 8, 2026

Via Benzinga · February 8, 2026

Markets face a critical week featuring an unusual mid-week jobs report Wednesday at 8:30am alongside Friday's January CPI data, creating a compressed economic data schedule that will test whether recent inflation concerns are justified or if price pr...

Via Barchart.com · February 8, 2026

The landscape of political forecasting has shifted beneath the feet of Washington insiders and retail traders alike. As of February 2026, the "Grand Relaunch" of PredictIt has officially transformed the platform from an embattled academic experiment into a fully regulated powerhouse known as the Aristotle Exchange. By shedding its restrictive "no-action" status and adopting a [...]

Via PredictStreet · February 8, 2026

The precious metal hit a new all-time high in January, only to end up crashing later on.

Via The Motley Fool · February 8, 2026

You always get what you pay for, so don't be afraid to pay up for a little more quality.

Via The Motley Fool · February 8, 2026

Knowing how you're doing compared to the average American doesn't tell you as much as you might think.

Via The Motley Fool · February 8, 2026

Retirees should brace themselves for both positive and negative changes to Medicare this year.

Via The Motley Fool · February 8, 2026

Wall Street's foremost financial institutional has transformed from Wall Street's bedrock to a stock market liability.

Via The Motley Fool · February 8, 2026

The bond market is speaking more loudly than the stock market about the likely direction of the Federal Reserve.

Via The Motley Fool · February 8, 2026

Jim Cramer said investor unease around Bitcoin resurfaced this week, pointing to Robinhood’s close correlation with the cryptocurrency as prices swung sharply near $60,000.

Via Stocktwits · February 8, 2026

There are quite a few reasons this asset is worth owning.

Via The Motley Fool · February 8, 2026

The beginning of the year saw the start of a transition to the new issuer.

Via The Motley Fool · February 7, 2026

Fed court blocks Trump's effort to shut down major infrastructure project. Pete Buttigieg accuses admin of violating commitments.

Via Benzinga · February 7, 2026

Some of these may be unavoidable, but others you can plan around.

Via The Motley Fool · February 7, 2026

This fund provides diversified commodity exposure with a systematic approach to inflation-sensitive assets and dynamic gold weighting.

Via The Motley Fool · February 7, 2026

The Fed is becoming more relaxed about the US jobs market. Yet, this week's data makes that look complacent. And payroll numbers next week will be key. So, what's going on beneath the surface?

Via Talk Markets · February 7, 2026

These companies have highly visible growth profiles for the next several years.

Via The Motley Fool · February 7, 2026

As of February 7, 2026, the era of aggressive interest rate cuts appears to have hit a significant roadblock. For months, investors had been pricing in a steady glide path toward lower rates, but a recent string of robust economic data and hawkish rhetoric from Federal Reserve officials has fundamentally reshaped the narrative. On the [...]

Via PredictStreet · February 7, 2026

With just twenty-four hours remaining until kickoff at Levi’s Stadium, the spotlight isn't just on the Seattle Seahawks and the New England Patriots. In the prediction markets, a different kind of high-stakes drama is unfolding. Traders have poured more than $7 million into Kalshi alone, speculating on every detail of the Apple Music (NASDAQ: AAPL) [...]

Via PredictStreet · February 7, 2026

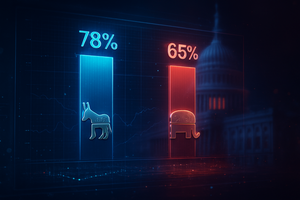

The race to lead the world’s most powerful financial institution has moved from the boardrooms of Washington to the high-stakes arena of prediction markets. As of February 7, 2026, Kevin Warsh has emerged as the overwhelming favorite to succeed Jerome Powell as Chair of the Federal Reserve, commanding a staggering 94% probability on the prediction [...]

Via PredictStreet · February 7, 2026

If you are looking for income, this high-yield consumer staples stock and even higher-yield energy business are top picks.

Via The Motley Fool · February 7, 2026

It's an error that could really ruin your retirement.

Via The Motley Fool · February 7, 2026

The most recent gold rush in weight loss drugs isn't done just yet.

Via The Motley Fool · February 7, 2026

See how much you can save by transferring your credit card debt to a 0% intro APR card -- plus tips to make the most of this type of credit card.

Via The Motley Fool · February 7, 2026