The Andersons, Inc. - Common Stock (ANDE)

59.37

-0.88 (-1.46%)

NASDAQ · Last Trade: Jan 25th, 2:00 AM EST

Detailed Quote

| Previous Close | 60.25 |

|---|---|

| Open | 60.05 |

| Bid | 45.80 |

| Ask | 59.95 |

| Day's Range | 59.20 - 60.88 |

| 52 Week Range | 31.03 - 62.10 |

| Volume | 273,103 |

| Market Cap | 1.98B |

| PE Ratio (TTM) | 27.74 |

| EPS (TTM) | 2.1 |

| Dividend & Yield | 0.7800 (1.31%) |

| 1 Month Average Volume | 269,248 |

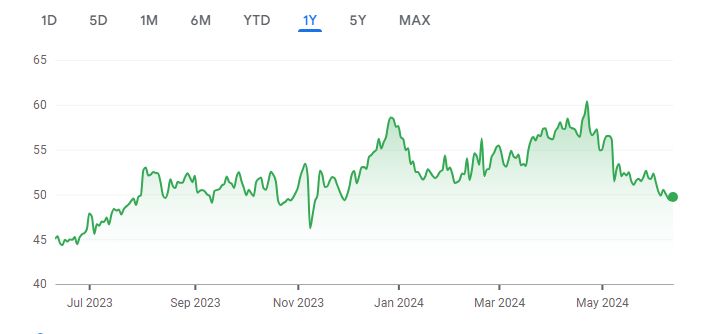

Chart

About The Andersons, Inc. - Common Stock (ANDE)

Andersons Inc is a diversified agricultural company that operates in various segments, including grain handling, plant nutrient distribution, and turf and specialty products. The company plays a crucial role in the agricultural supply chain by sourcing, storing, and marketing grain products, as well as providing essential inputs like fertilizers and crop protection products to farmers. Additionally, Andersons is involved in the production and distribution of high-quality turf and specialty products, serving both professional and consumer markets. Through its broad range of services and products, Andersons Inc supports agricultural productivity and sustainability. Read More

News & Press Releases

As of late January 2026, the global wheat market is demonstrating a surprising resilience that has caught many analysts off guard. Despite a series of bearish indicators—including record-shattering production in the Southern Hemisphere and a January USDA report that projected the highest global ending stocks in five years—prices

Via MarketMinute · January 20, 2026

This agricultural and nutrient leader has seen its stock grow just like its crops, but its director is chopping thousands of insider shares from his portfolio through multiple transactions.

Via The Motley Fool · January 15, 2026

As of December 2025, the global agricultural sector finds itself in a maelstrom of intensified trade disputes and escalating tariffs, profoundly reshaping international commodity flows and farmer livelihoods. A renewed surge in protectionist policies, notably between the United States and China, but also involving the European Union, Canada, and Mexico,

Via MarketMinute · December 11, 2025

Winnipeg, MB & Chicago, IL – December 9, 2025 – Agricultural commodity markets witnessed a day of divergent fortunes as Canola futures staged a modest recovery, while Wheat futures displayed mixed movements, reflecting a complex interplay of bargain hunting, ample global supplies, and persistent geopolitical tensions. The immediate implications point to a market

Via MarketMinute · December 9, 2025

As of November 21, 2025, the global corn market is experiencing a "tepid rally," a modest upward price movement struggling against a prevailing bearish sentiment. This subdued performance, characterized by limited gains despite occasional upticks, points to a challenging environment for agricultural commodities, primarily driven by robust global supplies and

Via MarketMinute · November 21, 2025

Andersons Inc is diversified company with its main focus in agriculture sector. Here is why we think it is a buy.

Via Talk Markets · June 21, 2024

November 19, 2025 – Commodity markets closed today with a mosaic of movements, as natural gas staged a notable rally driven by impending cold weather, while agricultural staples like canola and wheat experienced minor, yet distinct, fluctuations. The day's trading highlighted the intricate dance between weather patterns, global supply-demand dynamics, and

Via MarketMinute · November 19, 2025

The agricultural landscape is bracing for a complex year ahead, as insights from University of Illinois Professor Emeritus Mike Hutjens, shared during a recent Hoard's Dairyman webinar, paint a nuanced picture for the 2026 feed and forage outlook. With the webinar occurring on November 10, 2025, and a summary published

Via MarketMinute · November 18, 2025

November 17, 2025, closed with a tale of two distinct commodity markets, as canola futures experienced a significant bullish rally, climbing to multi-month highs, while wheat futures contended with a more subdued, largely bearish sentiment. The divergence underscores the unique supply and demand dynamics currently at play for these crucial

Via MarketMinute · November 17, 2025

Chicago, IL – November 5, 2025 – In a perplexing turn for agricultural markets, CBOT Corn futures have demonstrated an unexpected upward trajectory, significantly bolstered by a robust performance in wheat futures. This rally unfolds against a backdrop of what appears to be an ample global supply of both grains, presenting a

Via MarketMinute · November 5, 2025

The agricultural sector, long reliant on traditional forecasting methods, is on the cusp of a significant transformation. Helios AI, an innovative AgTech startup, has successfully secured $4.7 million in seed funding to launch Helios Horizon, an AI-powered copilot designed to provide unparalleled accuracy in agricultural commodity price prediction. This

Via MarketMinute · September 25, 2025

The Andersons Inc. reported mixed Q2 2025 results, with revenue beating estimates but EPS missing. The $425M TAMH acquisition aims to strengthen its biofuels segment. Investors remain cautious amid profitability challenges.

Via Chartmill · August 4, 2025

Let's delve into the US markets on Wednesday and uncover the stocks that are experiencing notable gaps in today's session. Below, you'll find the gap up and gap down stocks.

Via Chartmill · February 19, 2025

Via Benzinga · February 19, 2025

There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

Via Talk Markets · January 12, 2025

These consistently performing stocks offer long-term upside potential with stability today to help shield against volatility.

Via InvestorPlace · July 4, 2024

ANDE stock results show that Andersons beat analyst estimates for earnings per share but missed on revenue for the first quarter of 2024.

Via InvestorPlace · May 7, 2024

Companies Reporting Before The Bell • Barclays (NYSE:BCS) is likely to report quarterly earnings at $0.36 per share on revenue of $7.38 billion.

Via Benzinga · February 20, 2024