Horizon Bancorp, Inc. - Common Stock (HBNC)

17.60

-1.03 (-5.53%)

NASDAQ · Last Trade: Jan 25th, 5:52 AM EST

Detailed Quote

| Previous Close | 18.63 |

|---|---|

| Open | 18.56 |

| Bid | 16.02 |

| Ask | 18.95 |

| Day's Range | 17.56 - 18.56 |

| 52 Week Range | 12.70 - 19.07 |

| Volume | 475,652 |

| Market Cap | 773.53M |

| PE Ratio (TTM) | -4.478 |

| EPS (TTM) | -3.9 |

| Dividend & Yield | 0.6400 (3.64%) |

| 1 Month Average Volume | 336,234 |

Chart

About Horizon Bancorp, Inc. - Common Stock (HBNC)

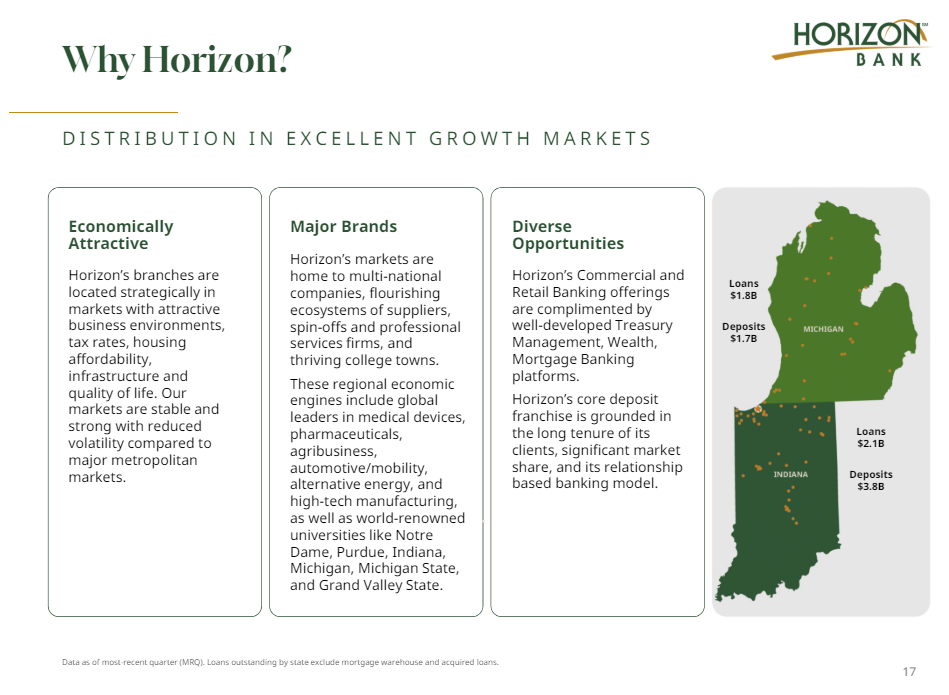

Horizon Bancorp is a financial services company that primarily operates as a bank holding company, providing a wide range of banking and financial products to individuals, businesses, and communities. It offers services including personal and commercial banking, mortgage lending, investment services, and wealth management. The company focuses on delivering personalized service and fostering long-term relationships with its customers, while also enhancing the economic growth of the regions it serves. With a commitment to community engagement, Horizon Bancorp aims to support local initiatives and create a positive impact within its marketplace. Read More

News & Press Releases

Horizon Bancorp (HBNC) Q3 2025 Earnings Transcript

Via The Motley Fool · January 22, 2026

Horizon Bancorp HBNC Earnings Call Transcript

Via The Motley Fool · January 22, 2026

Horizon Bancorp (HBNC) Q4 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

Horizon Bancorp (HBNC) Q3 2024 Earnings Transcript

Via The Motley Fool · January 22, 2026

Horizon Bancorp (NASDAQ:HBNC) Exceeds Q4 Earnings Estimates with Strong Performance Metricschartmill.com

Via Chartmill · January 21, 2026

Via Benzinga · September 2, 2025

Via Benzinga · August 26, 2025

Horizon Bancorp Inc/IN reports mixed Q2 2025 results with EPS beating estimates at $0.47, while revenue slightly missed. Shares rose 1.76% as net interest margin growth boosted profitability.

Via Chartmill · July 23, 2025

Ready to triple your passive income? Discover these 3 recession-proof dividend stocks built to thrive in any market!

Via The Motley Fool · May 1, 2025

Via Benzinga · April 23, 2025

HBNC stock results show that Horizon Bancorp beat analyst estimates for earnings per share and beat on revenue for the second quarter of 2024.

Via InvestorPlace · July 24, 2024

Horizon has managed to boost its dividend by an average of almost 11% annually in the past decade, which is extremely strong by the standards of the banking group.

Via Talk Markets · July 1, 2024

HBNC stock results show that Horizon Bancorp beat analyst estimates for earnings per share but missed on revenue for the first quarter of 2024.

Via InvestorPlace · April 24, 2024

Companies Reporting Before The Bell • Freeport-McMoRan (NYSE:FCX) is estimated to report quarterly earnings at $0.22 per share on revenue of $5.86 billion.

Via Benzinga · January 24, 2024

By the close of today, January 19, 2024, Horizon Bancorp (NASDAQ:HBNC) will issue a dividend payout of $0.16 per share, resulting in an annualized dividend yield of 4.70%. This payout is exclusively for shareholders who held the stock before the ex-dividend date on January 04, 2024.

Via Benzinga · January 19, 2024