Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC)

14.35

+0.26 (1.85%)

NASDAQ · Last Trade: Jan 23rd, 3:26 PM EST

Detailed Quote

| Previous Close | 14.09 |

|---|---|

| Open | 14.28 |

| Day's Range | 14.28 - 14.36 |

| 52 Week Range | 12.02 - 14.12 |

| Volume | 3,733,365 |

| Market Cap | - |

| Dividend & Yield | 0.5090 (3.55%) |

| 1 Month Average Volume | 4,895,438 |

Chart

News & Press Releases

As the first month of 2026 unfolds, a dramatic shift in market leadership is reshaping investor portfolios. For years, the dominant narrative was the unstoppable ascent of mega-cap technology, but by January 23, 2026, that story has encountered a significant rewrite. Investors are aggressively rotating out of high-flying AI and

Via MarketMinute · January 23, 2026

The size of the cut matters less than what was left behind and what it says about where diversification stops being worth the drag.

Via The Motley Fool · January 5, 2026

Election out of the way. Fed out of the way. Q3 earnings season is mostly over. Not many catalysts for a while. And that’s just the way I like it. Markets need to calm down and digest. Investors’ emotions need to recover. It’s been a whirlwind.

Via Talk Markets · November 9, 2024

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Friday, June 7.

Via Talk Markets · June 8, 2024

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Thursday, June 6.

Via Talk Markets · June 7, 2024

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Wednesday, June 5.

Via Talk Markets · June 6, 2024

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Tuesday, June 4.

Via Talk Markets · June 5, 2024

In this video, Ira Epstein reviews the day's trading in various SPDR-ETF markets for the trading day that ended, Monday, June 3.

Via Talk Markets · June 4, 2024

To gain an edge, this is what you need to know today.

Via Benzinga · May 15, 2024

An audience-requested triple header between commodities-focused ETFs from Blackrock iShares (COMT) and Invesco (PDBC).

Via Talk Markets · June 12, 2023

The markets haven’t been all that exciting this week. Choose your analogy. Watching paint dry. Watching grass grow. I chose the former since I am in full grass planting mode and it better grow quickly next week after the sun, rain and warmth coming.

Via Talk Markets · April 23, 2023

Investors may want to DIY in 2023.

Via Talk Markets · January 4, 2023

A return to a normal energy market could prove to be a double whammy for unwary inflation hedgers.

Via Talk Markets · September 20, 2022

Investors want to make money in markets, but sometimes it’s easier to make money by focusing less on economic reports and the Fed and instead think about the big picture more.

Via Talk Markets · August 23, 2022

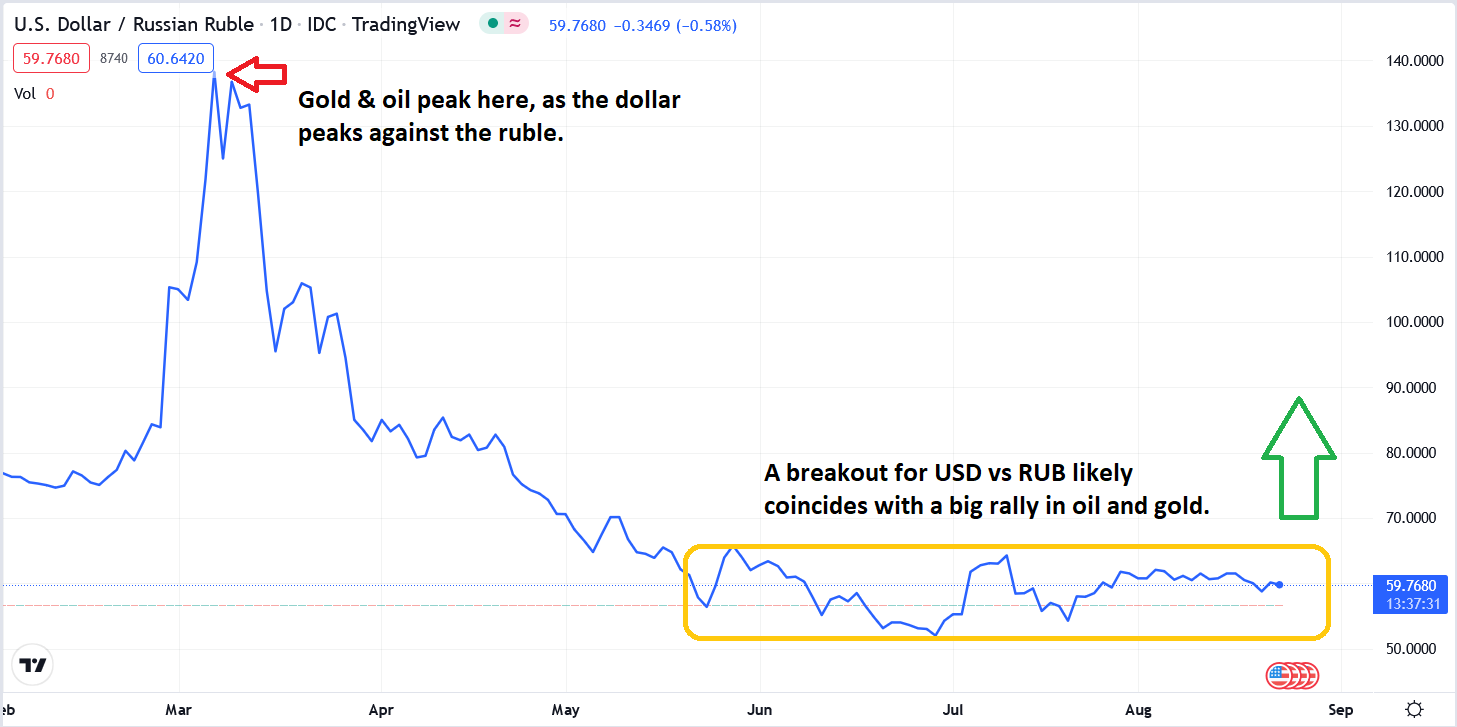

Looking forward, two alternative strategies - a currency play and an inflation hedge - point to two different return prospects for the remainder of the year.

Via Talk Markets · July 8, 2022

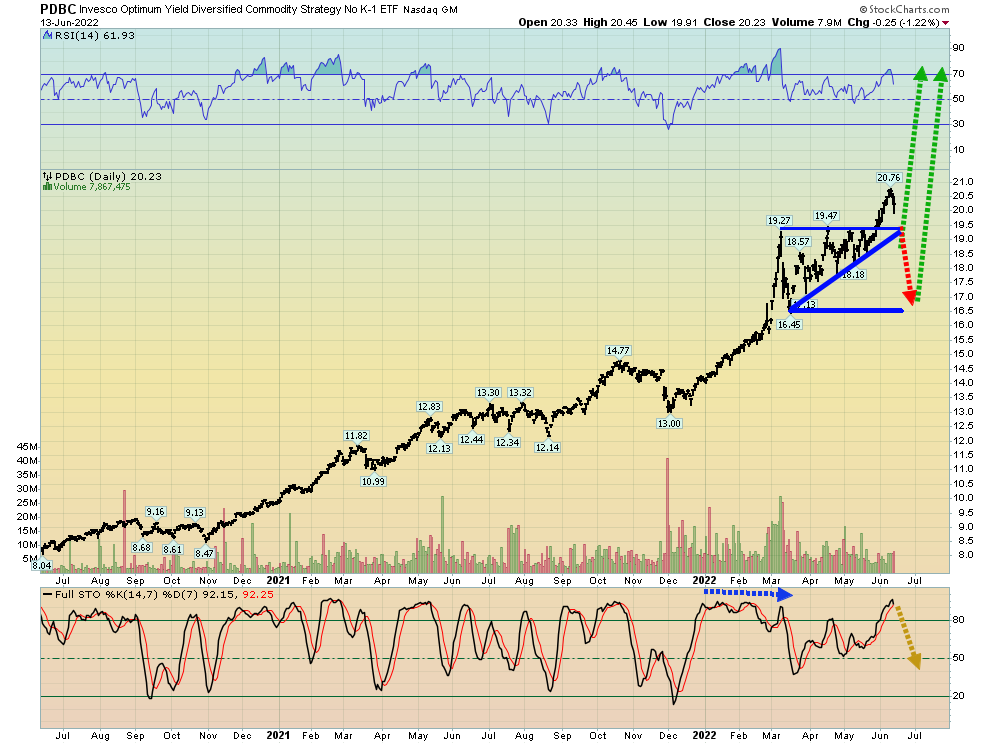

A major inflation cycle has well-defined stages. To prosper, investors need to allocate capital to the dominant theme of each stage.

Via Talk Markets · June 14, 2022

This brief video reviews the weekend's trading in various SPDR-ETF markets.

Via Talk Markets · May 1, 2022

Inventories of aluminum, copper, nickel, and zinc, four of the main contracts traded on the London Metal Exchange, have plunged by up to 70% over the past year, as record power...

Via Benzinga · April 13, 2022

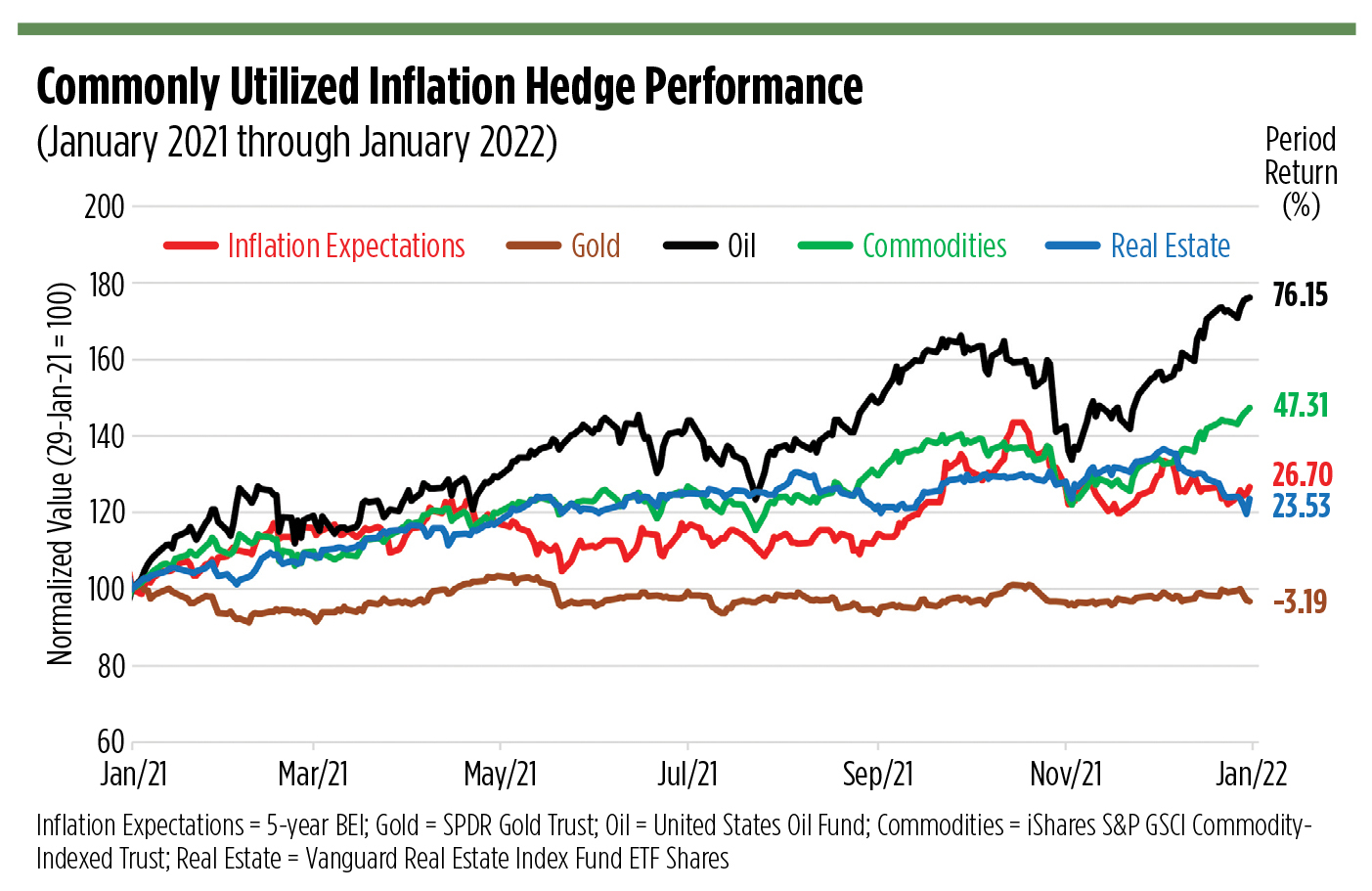

Is it time to tweak your investing portfolio to adapt to the potential for long-term inflation? Here are ways to do so.

Via Investor's Business Daily · April 8, 2022

Many experts predicted that inflation would cool off in spring as supply chains improve after pandemic-driven disruptions. It now appears that higher inflation could persist for longer.

Via Talk Markets · March 15, 2022

There’s more to it than ownership of a single asset. Here are the five most active broad-based commodity ETFs and what makes them tick.

Via Talk Markets · February 12, 2022

The rotation to banks and natural resource shares has begun, as these stocks to buy benefit from higher interest rates and a hawkish Fed.

Via InvestorPlace · January 24, 2022

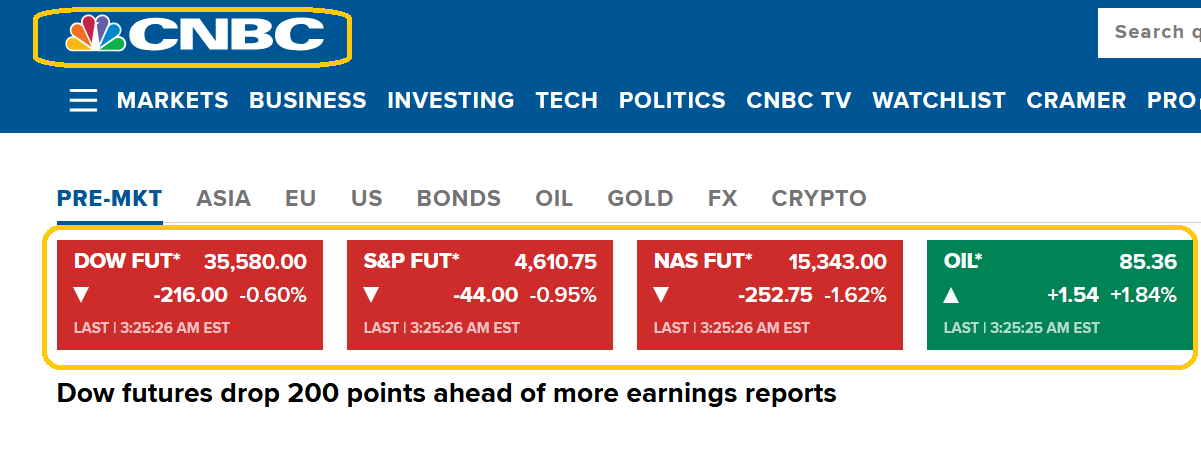

In the inflationary “bull era” underway now, a divergence is already apparent; commodities are surging as central banks tighten, and Western stock markets are tumbling.

Via Talk Markets · January 18, 2022

The first trading day of the new year is seasonally very strong by a number of studies and that is reinforced by the late day weakness to end 2021.

Via Talk Markets · January 3, 2022

Good morning, investor! We're at the end of the week and it starts off with the biggest pre-market stock movers for Friday!

Via InvestorPlace · December 3, 2021