Banco Santander, S.A. Sponsored ADR (Spain) (SAN)

12.40

-0.03 (-0.24%)

NYSE · Last Trade: Jan 26th, 1:12 AM EST

MILTON KEYNES, UK - January 22, 2026 - New research from Vanderhelm Research establishes Milton Keynes as the UK's premier tech and AI hub. With one in three jobs now in tech, autonomous vehicles on its streets, and the world's longest drone superhighway, the city leads UK innovation. Local SEO agency Metronyx AI SEO is pioneering AI-driven search strategies, ensuring businesses thrive in the new era of generative discovery.

Via AB Newswire · January 22, 2026

Vancouver, British Columbia--(Newsfile Corp. - January 20, 2026) - Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("Forge" or...

Via Newsfile · January 20, 2026

Today, Santander US announced a multi-year partnership with Villanova University Athletics naming Santander the Official Retail Bank Partner of Villanova Athletics and awarding a $1 million grant to Villanova University to provide scholarships for 50 student-athletes.

By Santander Holdings USA, Inc. · Via Business Wire · December 22, 2025

Vancouver, British Columbia--(Newsfile Corp. - November 28, 2025) - Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FSE: 5YZ) ("FRG" or...

Via Newsfile · November 28, 2025

Capital Estelar: Professor Fernando Silva Mendoza Leads a New Era of Intelligent Capital Transformation in Europe

Via Binary News Network · November 10, 2025

Santander Bank, N.A. announced today the launch of Navigator Global, a new digital platform designed to help small and mid-sized U.S. businesses explore, enter, and expand into international markets. The platform leverages Santander’s market expertise to support internationally ambitious business clients achieve global growth.

By Santander Bank, N.A. · Via Business Wire · November 6, 2025

Openbank by Santander, part of Santander Bank, N.A., today marks its first anniversary in the United States, celebrating strong momentum, innovation, and customer adoption in one of the world’s most dynamic banking markets.

By Santander Bank, N.A. · Via Business Wire · October 30, 2025

Millions of UK motorists who took out PCP car finance agreements between 2007 and 2021 may now be entitled to compensation for mis-selling. Consumers should start their claims now.

Via Prodigy · October 7, 2025

Search for the latest press releases from publicly traded companies, private corporations, non-profits and other public sector organizations.

Via NewMediaWire · October 3, 2025

BEDMINSTER, NJ - October 3, 2025 ( NEWMEDIAWIRE ) - Peapack-Gladstone Financial Corporation (NASDAQ Global Select Market: PGC) and Peapack Private Bank & Trust are pleased to announce that Alex Lurye has joined the Bank’s New York-based commercial banking team as Senior Managing Director.

Via TheNewswire.com · October 3, 2025

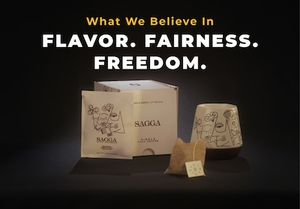

For coffee lovers who have ever been stuck with bitter hotel brews, watery office coffee, or overpriced chain-shop cups, relief is on the way. Sagga Coffee is launching on Kickstarter, introducing portable brew bags filled with award-winning, single-farm coffee. No machine, no compromise, and no middlemen.

Via Get News · October 2, 2025

Lindsey Stirling, the trailblazing violinist, dancer, and composer, continues to captivate the world with her innovative fusion of classical violin, electronic beats, and high-energy performances. As of September 2025, her 2025 tour slate is in full swing, blending the rock-infused nEVEREST Duality Tour co-headlining with Halestorm and the enchanting holiday Snow Waltz Tour inspired by her festive album. With dates spanning fall through winter, fans across North America have plenty of chances to witness her live magic. This guide dives into her complete 2025 concert schedule, spotlights her top singles in bullet-point format, and reveals how to snag the cheapest tickets using Promo Code CITY10 at CapitalCityTickets.com—your ultimate source for verified, affordable access.

Via AB Newswire · September 20, 2025

Vision & Market Positioning Mozafx positions itself as the “Next-Generation Borderless Brokerage”, redefining how traders and institutions interact with the global markets. Specializing in high-leverage international spot gold trading and diversified commodities such as crude oil, silver, and agricultural products, Mozafx integrates cutting-edge fintech solutions with institutional-grade security.

Via GlobePRwire · August 21, 2025

Santander Bank, N.A. (“Santander Bank”) today announced findings from a new survey revealing that younger generations, especially Gen Z, were able to increase their savings in 2025. The survey found 58% of Gen Zers and 54% of Millennials increased their savings since the start of the year, ahead of their Gen X (47%) and Baby Boomer (39%) counterparts.

By Santander Bank, N.A. · Via Business Wire · August 20, 2025

Vancouver, British Columbia--(Newsfile Corp. - August 13, 2025) - Forge Resources Corp. (CSE: FRG) (OTCQB: FRGGF) (FFSE: 5YZ) ("FRG" or...

Via Newsfile · August 13, 2025

Santander Holdings USA, Inc. (“Santander US”) today announced new survey findings that show middle-income Americans have accelerated their car buying timelines amid uncertainty about future prices. While 52% had delayed a vehicle purchase over the past year due to cost, 55% are now considering buying in the year ahead, up from 47% in Q1. This is the first time in eight quarters of research that prospective buyers outnumber those delaying a purchase—indicating that pent-up demand may be transitioning to sales activity. Additionally, 18% expedited key purchases in Q2 to get ahead of any price changes, with 41% of them buying a vehicle.

By Santander Holdings USA, Inc. · Via Business Wire · July 28, 2025

Are you ready to experience the progressive metal mastery of Dream Theater live in 2025? The Grammy-winning band, known for their technical brilliance and epic live performances, is embarking on their 40th Anniversary Tour 2024–2025, featuring the return of drummer Mike Portnoy. At CapitalCityTickets.com, fans can score the best deals on Dream Theater 2025 tour tickets using the exclusive promo code CITY10 for an additional 10% off. This guide will help you secure affordable tickets, provide the complete 2025 North American tour schedule, highlight Dream Theater’s top singles, and offer tips for an unforgettable concert experience.

Via AB Newswire · July 27, 2025

Santander US today announced a $25 million commitment in support of education, employability and entrepreneurship that will include over $10 million in university grants and national scholarship funding through the Santander Universities program. The scholarship applications will be available later this Summer on Santander Open Academy, a global platform available to anyone around the world that offers 100% free educational content and upskilling tools to improve professional skills and employability.

By Santander Holdings USA, Inc. · Via Business Wire · July 14, 2025

The Board of Governors of the Federal Reserve System (the “Federal Reserve”) informed Santander Holdings USA, Inc. (“SHUSA”) on June 27, 2025, of SHUSA’s updated stress capital buffer (“SCB”) requirement, which becomes effective on October 1, 2025. SHUSA’s updated SCB will be 3.4% of its common equity Tier 1 capital (“CET1”), resulting in an overall CET1 capital requirement of 7.9%.

By Santander Holdings USA, Inc. · Via Business Wire · July 1, 2025

Santander Bank, N.A. (“Santander Bank” or “Santander”) today announced that it has entered into an agreement with Community Bank, N.A. (“Community Bank”), a subsidiary of Community Financial System, Inc., for the sale of seven branches in the Allentown, Pennsylvania, area. The branches are located in Allentown, Bethlehem, Coopersburg, Easton, Emmaus and Whitehall.

By Santander Bank, N.A. · Via Business Wire · June 25, 2025

Edgar Ramirez, a Colombian-American author and life coach, is proud to announce the release of his highly anticipated book, “ Life Reborn .” This transforming work digs deep into the complications of human emotions, going through life’s challenges, and the journey of self-development. Through rich narratives and profound reflections, Ramirez invites readers to begin the journey of self-discovery, persistence, and empowerment.

Via Binary News Network · June 19, 2025

As part of their ongoing editorial series exploring design-driven innovation in the marine sector, Botin Partners is spotlighting their recent collaborations with Baltic Yachts and Wally Yachts in the modern trend toward lightweight construction, hydrofoil technologies, and adaptable race-readiness.

Via Press Release Distribution Service · June 18, 2025

Santander Bank, N.A. (“Santander Bank”) today announced the results of a new survey that reveals misunderstandings about financial accounts, such as savings and investments, could be leading to a misalignment between consumers' financial goals and where they keep their money. For instance, 52% do not realize a high-yield savings account is a good place to keep emergency savings, and just 28% know these accounts with an FDIC member institution are safe and secure1. This confusion comes at a time when Americans are increasingly worried about market conditions, putting even more significance on their financial decisions.

By Santander Bank, N.A. · Via Business Wire · June 3, 2025

Santander Bank, N.A. (“Santander Bank” or “the Bank”) today announced the unveiling of its first Openbank location in the United States, located at 150 NE 8th Street in the new Miami Worldcenter. Ready to greet customers today, the new location will offer all of the services of a Santander Bank branch, and information about its Openbank division’s digital-first banking products – including Openbank’s High Yield Savings account with a rate 10x the national average*, investment services available through Santander Investment Services (a division of Santander Securities LLC)**, exceptional in-person customer service, on-site private meeting spaces, and a complimentary premium amenity bar for customers and non-customer community members alike. Similar to Santander’s Work Café in Coconut Grove, Openbank is intended to serve as an innovation hub for creators, small businesses, and the broader community.

By Santander Bank, N.A. · Via Business Wire · May 22, 2025

Santander Bank N.A. (“Santander Bank” or “the Bank”) today announced that the recently launched Openbank by Santander digital platform in the United States has surpassed 100,000 customers within its first six months of operation, exceeding expectations. This achievement is a significant milestone in advancing the Santander US business strategy to generate lower-cost, national deposits to position its Retail Bank for further success and fuel its leading Auto lending franchise in 2025.

By Santander Bank N.A. · Via Business Wire · May 21, 2025