Tyson Foods (TSN)

61.66

+0.54 (0.88%)

NYSE · Last Trade: Jan 24th, 5:42 PM EST

In a high-stakes move to protect the backbone of American agriculture, the United States Department of Agriculture (USDA) has officially launched a $100 million "Grand Challenge" aimed at halting the northward advance of the New World screwworm (NWS). Announced on January 21, 2026, by U.S. Secretary of Agriculture Brooke

Via MarketMinute · January 23, 2026

Wall Street’s bearish price targets for the stocks in this article signal serious concerns.

Such forecasts are uncommon in an industry where maintaining cordial corporate relationships often trumps delivering the hard truth.

Via StockStory · January 22, 2026

The United States livestock market is currently navigating an unprecedented landscape of record-high prices and historic supply scarcity. As of January 20, 2026, live cattle futures have surged to all-time highs, driven by a national herd that has shriveled to its smallest size since the Truman administration. The convergence of

Via MarketMinute · January 20, 2026

Tyson Foods (NYSE:TSN) Shows Bull Flag Pattern in High-Probability Breakout Setupchartmill.com

Via Chartmill · January 5, 2026

The agricultural sector is reeling this week following the release of the United States Department of Agriculture (USDA) January 2026 Crop Production Annual Summary and World Agricultural Supply and Demand Estimates (WASDE). In a move that caught even seasoned commodity traders off guard, the USDA confirmed a record-shattering corn harvest,

Via MarketMinute · January 20, 2026

CHICAGO — The cattle market, which had been charging through the early weeks of 2026 with historic momentum, hit a punishing wall on Friday, January 16. In a session that sent shockwaves through the agricultural sector, feeder cattle futures experienced a staggering collapse, with some contracts falling by more than $8

Via MarketMinute · January 19, 2026

The United States agricultural sector is reeling from a "supply avalanche" following the U.S. Department of Agriculture's (USDA) January 2026 World Agricultural Supply and Demand Estimates (WASDE) report, which confirmed a record-shattering corn harvest of 17.021 billion bushels. This unprecedented production level, the first time the U.S.

Via MarketMinute · January 19, 2026

A stock with low volatility can be reassuring, but it doesn’t always mean strong long-term performance.

Investors who prioritize stability may miss out on higher-reward opportunities elsewhere.

Via StockStory · January 14, 2026

The dawn of 2026 has brought a starkly divided landscape to the American livestock sector. According to the latest market tracking from DTN Progressive Farmer, the cattle complex has entered the year in an "aggressive rally," with prices for fed and feeder cattle pushing toward levels unseen in decades. This

Via MarketMinute · January 13, 2026

The American heartland has produced a harvest of historic proportions, with the U.S. Department of Agriculture (USDA) confirming a record-shattering 17.021 billion bushels of corn for the 2025-2026 season. This unprecedented supply, revealed in the January 12, 2026, World Agricultural Supply and Demand Estimates (WASDE) report, has immediately

Via MarketMinute · January 13, 2026

The global agricultural landscape is grappling with a profound "protein pivot." Recent data from the United Nations Food and Agriculture Organization (FAO) reveals a complex decoupling within the global food basket: while staple cereal prices have stabilized near multi-year lows, the meat and dairy sectors are navigating a volatile cocktail

Via MarketMinute · January 12, 2026

The United Nations Food and Agriculture Organization (FAO) released its highly anticipated December 2025 Food Price Index report on January 9, 2026, revealing a complex picture of the global kitchen table. While the month of December saw a notable dip in the prices of dairy, meat, and vegetable oils, the

Via MarketMinute · January 12, 2026

The global effort to curb food inflation received a significant boost as the year 2025 drew to a close. According to the latest report from the Food and Agriculture Organization (FAO) of the United Nations, the benchmark index for world food commodity prices fell for the fourth straight month in

Via MarketMinute · January 9, 2026

The livestock market has kicked off 2026 with a surge of activity, as tight supplies and robust demand continue to push prices toward historic highs. At the recent Holsworthy Market auction on January 7, 2026, the atmosphere was described by traders as "on fire," with a massive entry of livestock

Via MarketMinute · January 8, 2026

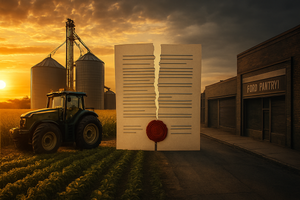

As of early January 2026, the American agricultural landscape is navigating its most significant policy transformation since the New Deal. The traditional "Farm Bill era"—characterized by a decennial, bipartisan omnibus package that married rural commodity subsidies with urban nutrition programs—has effectively ended. In its place stands a fragmented,

Via MarketMinute · January 7, 2026

Before its Q1 FY2026 earnings release, here’s what analysts are expecting from this underperforming stock.

Via Barchart.com · January 5, 2026

As the 2026 calendar year begins, the United States agricultural sector finds itself at a critical policy crossroads. On one hand, the U.S. Department of Agriculture (USDA) has just finalized the enrollment for its $12 billion Farmer Bridge Assistance (FBA) program, a massive infusion of ad-hoc cash designed to

Via MarketMinute · January 2, 2026

As of January 1, 2026, the landscape of American agricultural sovereignty has reached a critical juncture in the Great Plains. Following a three-year legislative blitz aimed at curbing foreign influence, Oklahoma has fully implemented a sweeping ban on land ownership by "adversarial" foreign nations, most notably China. However, the dust

Via MarketMinute · January 1, 2026

As the calendar turns to 2026, the American agricultural sector finds itself at a precarious crossroads, battered by a year of escalating trade tensions and a "Trade War 2.0" that has redefined global commodity flows. Throughout 2025, Senator Jerry Moran (R-Kan.) emerged as one of the most consistent and

Via MarketMinute · January 1, 2026

Pricing is not the only issue for Beyond Meat.

Via The Motley Fool · December 31, 2025

JACKSON, Miss. — In a stark reversal of fortune for the nation’s largest egg producer, Cal-Maine Foods Inc. (NASDAQ: CALM) saw its shares tumble to a 52-week low of $79.42 on Tuesday. The drop marks a significant retreat from the record-breaking highs seen earlier this year, signaling an end

Via MarketMinute · December 30, 2025

Via Benzinga · December 30, 2025

As of late December 2025, the United States livestock market is navigating a period of profound structural upheaval, defined by a historic divergence between the beef and dairy sectors. While cattle producers are grappling with a herd size not seen since the 1950s—sending beef prices to unprecedented heights—the

Via MarketMinute · December 26, 2025

The American beef industry is entering a period of unprecedented structural upheaval as a shrinking national cattle herd and a massive reduction in processing capacity collide. In a dual blow to the sector, the latest USDA Cattle on Feed report has revealed a staggering 11% drop in cattle placements, while

Via MarketMinute · December 25, 2025